The Legacy Dilemma in Modern Banking

Every bank is investing in digital transformation, yet only a few emerge as true digital leaders. Why? The answer lies in legacy systems.

Financial institutions today face a pivotal crossroads. Rising customer expectations, tightening regulatory requirements, and increasing competition from fintech disruptors have exposed the limitations of legacy banking systems. Often burdened with technical debt, these outdated infrastructures slow innovation, inflate operational costs, and hinder the overall customer experience.

In fact in 2025, 68% of banking IT leaders acknowledge that legacy infrastructure is a key obstacle to delivering seamless digital experiences.

Source: Baringa report on legacy tech challenges in banking

Yet banks that successfully modernize report a 38–52% reduction in total cost of ownership and up to a 62% acceleration in bringing new products to market, demonstrating the clear business value of overcoming legacy hurdles.

Source: Digital Bank Expert analysis on true cost of legacy systems

This blog explores how financial institutions can overcome legacy system challenges and achieve digital agility through the nCino–Salesforce ecosystem, paving the way from legacy limits to digital leadership.

Enter the nCino-Salesforce Ecosystem

The nCino-Salesforce ecosystem combines the robust CRM and cloud capabilities of Salesforcewithbanking-specific workflows from nCino, creating a fully integrated, end-to-end platform. Institutions benefit from scalability, security, and AI-driven insights via Salesforce Einstein, while teams across sales, service, compliance, and operations work from a single source of truth.

This seamless integration allows banks to reimagine products, accelerate processes, and deliver a superior customer experience, all while maintaining compliance and operational efficiency. By unifying front, middle, and back-office functions, the platform eliminates silos and empowers teams to act with confidence and agility.

“nCino-Salesforce doesn’t just digitize; it transforms how banks innovate, operate, and engage customers.”

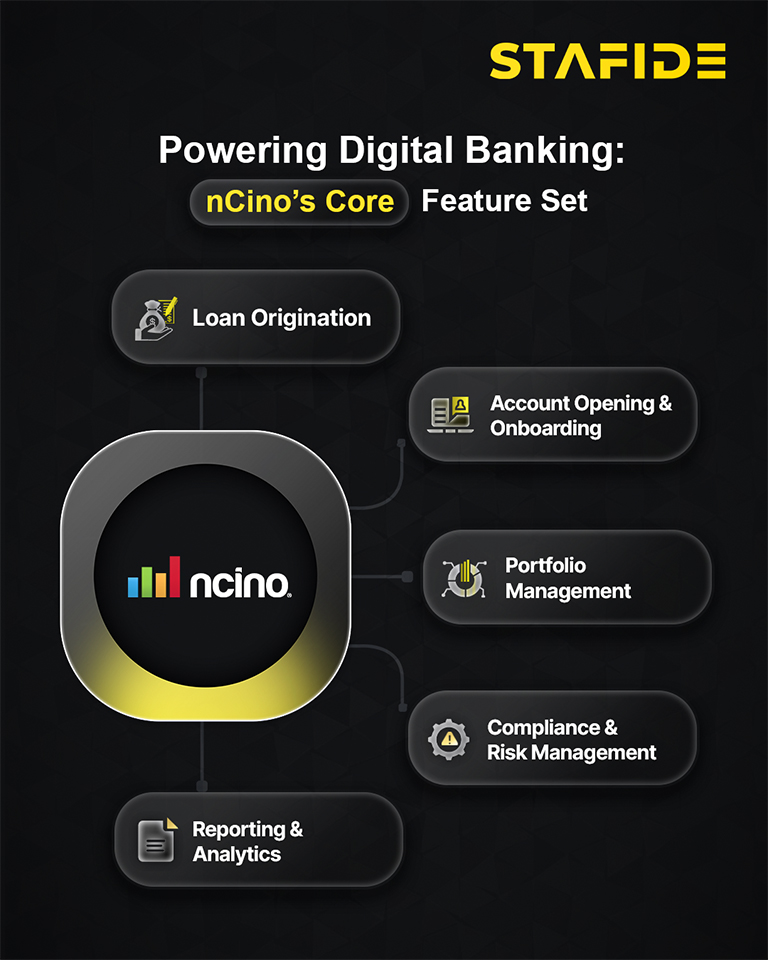

The Digital Core: Unpacking nCino’s Power Features

- Loan Origination: nCino automates the entire lending process, from customer application through credit analysis, approvals, documentation, and funding. Built-in analytics and decisioning tools improve turnaround times while reducing human error. This is especially transformative for commercial and SME banking, where complex deals often face bottlenecks.

- Account Opening and Onboarding: With nCino, opening an account becomes a seamless, end-to-end digital experience. The platform supports identity verification, KYC checks, and documentation workflows in a unified interface. Customers can onboard in minutes rather than days, improving first impressions and driving retention.

- Portfolio Management: Real-time insights into loan performance, delinquencies, and growth opportunities enable better portfolio risk management. Relationship managers can proactively identify cross-sell opportunities and respond faster to client needs.

- Compliance and Risk Management: The platform includes tools for automated compliance monitoring, AML screening, and audit trails. Risk assessment models are embedded, enabling dynamic risk scoring and early warning indicators.

- Reporting and Analytics: Embedded dashboards and customizable reports offer visibility into every layer of operations. Whether it is tracking loan pipeline velocity or analyzing branch-level performance, decision-makers have the data they need to act with confidence.

Real-World Success Stories

A Top 30 Bank

A top 30 bank enhanced their DevOps pipeline by integrating nCino with Salesforce using AutoRABIT tools. This improved release quality, metadata management, and multi-team collaboration while ensuring compliance in fast-paced banking IT operations.

(Source: AutoRABIT)

Accenture Banking Personalized Experiences

Accenture partnered with Thought Machine, Salesforce, and nCino to deliver personalized banking experiences using an integrated ecosystem. This innovation improves customer engagement, accelerates product launch, and supports new revenue streams while enhancing risk management.

(Source: Accenture Banking Personalised Experiences on Salesforce)

Strategic Benefits of the Ecosystem

- Improved Efficiency: Automating manual processes reduces errors and allows employees to focus on higher-value tasks. Banks have observed significantly faster loan processing times following implementation.

- Enhanced Customer Experience: Omnichannel capabilities, faster onboarding, and real-time updates contribute to a smoother, more engaging customer journey, with improved satisfaction reported by institutions post-nCino deployment.

- Better Risk Management: Real-time analytics and compliance monitoring allow for proactive risk management. Regulatory audits become smoother and less time-consuming.

- Increased Agility: Cloud-native infrastructure allows banks to launch new products faster, respond to market changes quickly, and scale operations with ease.

Implementation Challenges and How to Overcome Them

While the nCino-Salesforce ecosystem delivers transformative benefits, implementing such a comprehensive platform is not without challenges. Institutions often face hurdles such as migrating data from legacy systems, aligning cross-functional teams with new workflows, and ensuring regulatory compliance throughout the rollout.

To overcome these challenges, a phased implementation strategy is often recommended. Starting with a pilot department or product line allows teams to test workflows, resolve issues, and gather feedback before scaling across the organization. Strong governance and clear communication from leadership help align teams and reduce resistance to change.

Recruitment firms play a critical role during this phase by sourcing professionals with the right skills such as data migration specialists, business analysts, and compliance experts, ensuring institutions have the talent required to implement the platform effectively. Combined with structured training programs and change management strategies, this approach enables organizations to maximize the benefits of nCino-Salesforce while minimizing operational disruptions.

Measuring Success: KPIs for nCino-Salesforce Projects

Tracking tangible results is crucial for evaluating the impact of nCino-Salesforce. Key performance indicators (KPIs) help institutions measure both operational efficiency and customer satisfaction. Common metrics include:

- Loan Processing Turnaround: Reduction in the time from application to funding, reflecting faster, automated workflows.

- Account Onboarding Time: Measurement of how quickly customers complete KYC and open accounts digitally.

- Customer Satisfaction Scores (NPS/CSAT): Improved satisfaction driven by enhanced digital experiences.

- Regulatory Compliance Metrics: Fewer audit findings and reduced compliance-related delays.

- Employee Productivity: Efficiency gains achieved through automation and streamlined processes.

By establishing these KPIs from the outset, institutions can track progress, demonstrate ROI, and continuously refine their nCino-Salesforce implementation. Moreover, having skilled professionals in key roles ensures that these improvements are sustainable and scalable, reinforcing the strategic value of the platform.

Talent and People Perspective: Building the Right Team

The successful implementation of the nCino-Salesforce ecosystem hinges on having the right talent in place. Financial institutions need professionals who can bridge the gap between technology and banking operations. Key roles include:

- nCino Administrators: Manage system configurations and ensure smooth operations.

- Salesforce Developers: Tailor the platform’s features and functionality to align with unique business requirements.

- Business Analysts: Translate business requirements into technical solutions.

- Compliance Officers: Ensure that all processes adhere to regulatory standards.

Recruitment firms specializing in financial services can play a pivotal role in sourcing and placing qualified candidates for these roles. Their expertise in understanding the nuances of the banking sector ensures that institutions build a competent team capable of leveraging the full potential of the nCino-Salesforce ecosystem.

“Technology doesn’t transform businesses; people do. Equip the right talent, and digital transformation becomes unstoppable.”

Looking Ahead: Trends and Opportunities

Cloud-native banking platforms are becoming essential for institutions aiming to stay competitive and agile. Solutions like nCino on Salesforce enable streamlined operations and real-time insights, helping organizations respond effectively to evolving market demands.

Regulators are increasingly acknowledging the value of cloud-first platforms in enhancing transparency, security, and operational resilience. Institutions that adopt these technologies are better positioned to navigate change, maintain compliance, and enhance customer experiences in a dynamic financial ecosystem.

Conclusion: Leadership Begins with the Right Ecosystem

Embracing the nCino-Salesforce ecosystem transforms the way institutions operate, enabling smarter decision-making, streamlined processes, and stronger compliance. Beyond technology, it provides a framework for sustainable growth and strategic leadership, positioning organizations to thrive in a banking environment defined by competition, innovation, and customer expectations.

Unlock Top Talent for Your nCino-Salesforce Transformation

Stafide connects you with skilled professionals who can fully leverage the nCino-Salesforce ecosystem, helping you build a high-performing team and accelerate digital initiatives.

Partner with us today to stay ahead in your market.